Current Liabilities Accounting (Cash Rebate With Coupon Offerred With Sales Of Products)

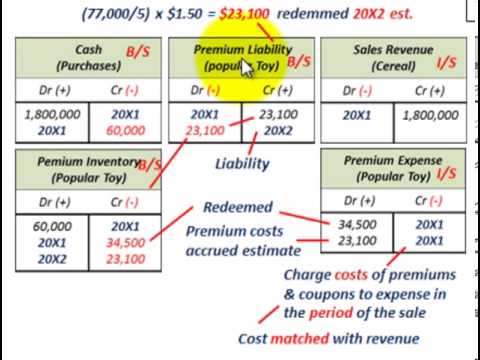

Accounting for cash rebates using coupons issued with the sale of a product to promote the product, example is where a manufacturer includes in sale of their product coupons that can be redeemed for a cash rebate, first have to determine coupon to be redeemed, (total coupons issued x percentage estimated to be redeemed - coupons redeemed todate = estimated coupons to be redeemed), setup a liability for unredeemed coupons and recognize the cost of the premiums and coupons in the period of the sale to match costs to revenues, detailed example by Allen Mursau

Accounting for cash rebates using coupons issued with the sale of a product to promote the product, example is where a manufacturer includes in sale of their product coupons that can be redeemed for a cash rebate, first have to determine coupon to be redeemed, (total coupons issued x percentage estimated to be redeemed – coupons redeemed todate = estimated coupons to be redeemed), setup a liability for unredeemed coupons and recognize the cost of the premiums and coupons in the period of the sale to match costs to revenues, detailed example by Allen Mursau

For journal entries, they will look like these?

Cash 4,800,000 DR

Sales Revenue 4,800,000 CR

(products sold)

Rebate Expense 115,000 DR

Cash 115,000 CR

(Redeemed rebate coupons)

Rebate Expense 77,000 DR

Rebate Liability 77,000 CR

(Future rebate coupons to be redeemed)

great video do you have a coupon example for a free service, ie 5 service calls next one free?