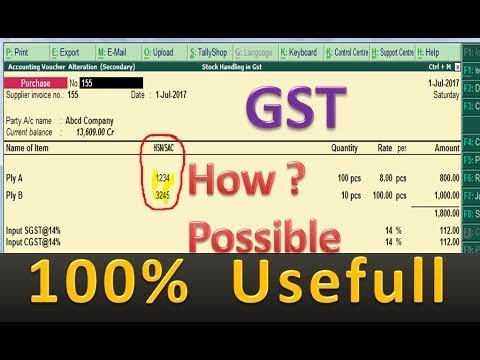

GST EXPENSES ENTRIES UNDER RCM METHOD IN TALLY

This video covers the topic GST Expenses Accounting Entries for Indirect Expenses Direct Expenses, Purchase Goods, Such as GTA Expenses, Stationery Expenses, Transportation Charges, Rent for Building, expenses in gst with tally erp 9. Learn How to pass all expenses entries in tally and how to get input credit under RCM Method of GST, How to Pay Tax to Government. Lern GST Accounting Entries for Reverse Charge on Expenses Paid to Unregistered Dealer in

This video covers the topic GST Expenses Accounting Entries for Indirect Expenses Direct Expenses, Purchase Goods, Such as GTA Expenses, Stationery Expenses, Transportation Charges, Rent for Building, expenses in gst with tally erp 9. Learn How to pass all expenses entries in tally and how to get input credit under RCM Method of GST, How to Pay Tax to Government. Lern GST Accounting Entries for Reverse Charge on Expenses Paid to Unregistered Dealer in

agar CA ko fees pay karte hain to kisme dalenge under kiske aayega

I just want to know, can we take input tax credit on expenses(both registered & unregistered dealer)? And it will be entered in journal voucher or purchases voucher? And what entry will be pass?

Plz reply

..

also tell me how book expeneses without inventary of various hsn codes with registred dealer

how to enabal classification of gst in tally pls tell me

please provide gst tally notes . my email id – rchejara840@gmail.com

tally video

thanku mam

thanku very much

Mam Bank ki entry pe 1 Video banao please

thank you very much madam

PLZ TELL ME IF I DID SERVISE ON MY GENERATOR THN SERVICE BILL CAN BE ENTER IN TALLY IN JOURNAL OR PURCHASE

I purchased a tally software & how can i this entry in tally . pls provide this video my mail id sugo0018@gmail.com

if a company directaly pass any scheme or insentive to retailers and made credit note of the passed total amount in name of distributor and against this credit note co. make a invoice in the name of distributor for adjustment of account in his company ladger , and now as per gst rule co. said to distributor to raise a invoice for commission on company with adding gst 18% . so plz let me know that how the entry pass in tally and how genarate a commision invoice on company. also teach how to these commission pass to retailer which is allready paid directaly pass by the co to retailers.

Thanks… Madam!