How to Price/Value Bonds – Formula, Annual, Semi-Annual, Market Value, Accrued Interest

http://www.subjectmoney.com

http://www.subjectmoney.com/definitiondisplay.php?word=Bond%20Pricing

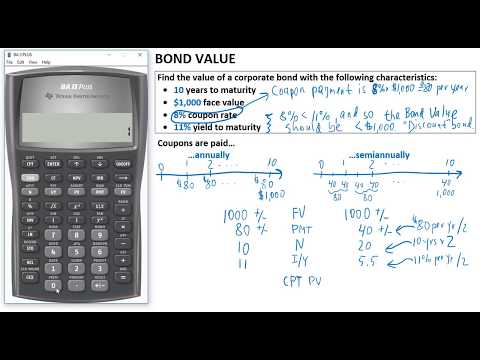

In this video we show you how to calculate the value or price of a bond. We teach you the present value formula and then use examples to discount the coupon payments and principle payment to their present value. We also show you how to solve the price of a semi-annual bond. In this case you would multiply the periods by two and divide the YTM and coupon payments by 2. We also show you how to solve the accrued interest of a bond to find out what it would sell for at a date that is not on the exact coupon payment date.

https://www.youtube.com/user/Subjectmoney

https://www.youtube.com/watch?v=7zCqoED8MVk

http://www.roofstampa.com

hjttp://roofstampa.com

http:/www.subjectmoney.com

http://www.excelfornoobs.com

http://www.subjectmoney.com

http://www.subjectmoney.com/definitiondisplay.php?word=Bond%20Pricing

In this video we show you how to calculate the value or price of a bond. We teach you the present value formula and then use examples to discount the coupon payments and principle payment to their present value. We also show you how to solve the price of a semi-annual bond. In this case you would multiply the periods by two and divide the YTM and coupon payments by 2. We also show you how to solve the accrued interest of a bond to find out what it would sell for at a date that is not on the exact coupon payment date.

https://www.youtube.com/user/Subjectmoney

https://www.youtube.com/watch?v=7zCqoED8MVk

http://www.roofstampa.com

hjttp://roofstampa.com

http:/www.subjectmoney.com

http://www.excelfornoobs.com

This is a really clear, concise video explanation

Such a life savior. Thanks man keep it up

Thanks for the video! Just wanted to confirm that changing the payment period for the coupon would change the value of the bond.

In first step you only multiplied but in 2nd step why you divided

chill with the annotations

There's not a easier formula to use at @5:38 than to do all that by hand? I got 16 periods I got to calculate….

Thanks for the good work. This video has helped me with exam questions which I was struggling to understand. I look forward to watching more of your videos.

Determine price you would pay for following bond: $1000 bond at maturity in 5 years, 3% coupon, investors minimum required rate of return is 8%? Help?

How is it possible that a semi-annual bond with same coupon, par value and YTM has a lower value than a bond with annual payments?

try explaining using the present value of an annuity formula + the present value of a lump sum payment to explain so the formula at the end doesnt look so confusing for those who are new to this concept?

cheers

please help me!

bonds with face value of 100$ with a term of 10 years, coupon rate=9%, bond has issued 5 years ago. Return ratio required is 11%. What is the current price of the bond?

I'm not sure about the result

14 years to maturity. selling at $967. At this price, bond yields 7.9%. What is the coupon rate of this bond?

Too good! The illustrations are so clear!

alright u didnt explain like anything. the part u slowed down on was the semi annual part where all u did was divide and multiply things by 2. thats not the tricky part. the tricky part is the formula u use, what each thing is, etc. u dont explain this so is this video for people who already know how to do all this just not divide or multiply by two?

thank you very helpfull!

Thank you..Really Helped..:)

If my free tutorials have helped you in any way please repay by liking, commenting, sharing and saving the videos to your favorites. Your interaction improves the search ranking of my tutorials which motivates me to keep making more. Thanks for the support!

I'm really glad I could help. Thanks for watching and please don't forget to subscribe!

By simply showing the squred values for each year and the final face/par value computation, you've given me a "legend" that is so much easier to comprehend than all of my senior college level financial textbooks. I was able to accurately do some calcualtions after watching this video only once. Thank you!